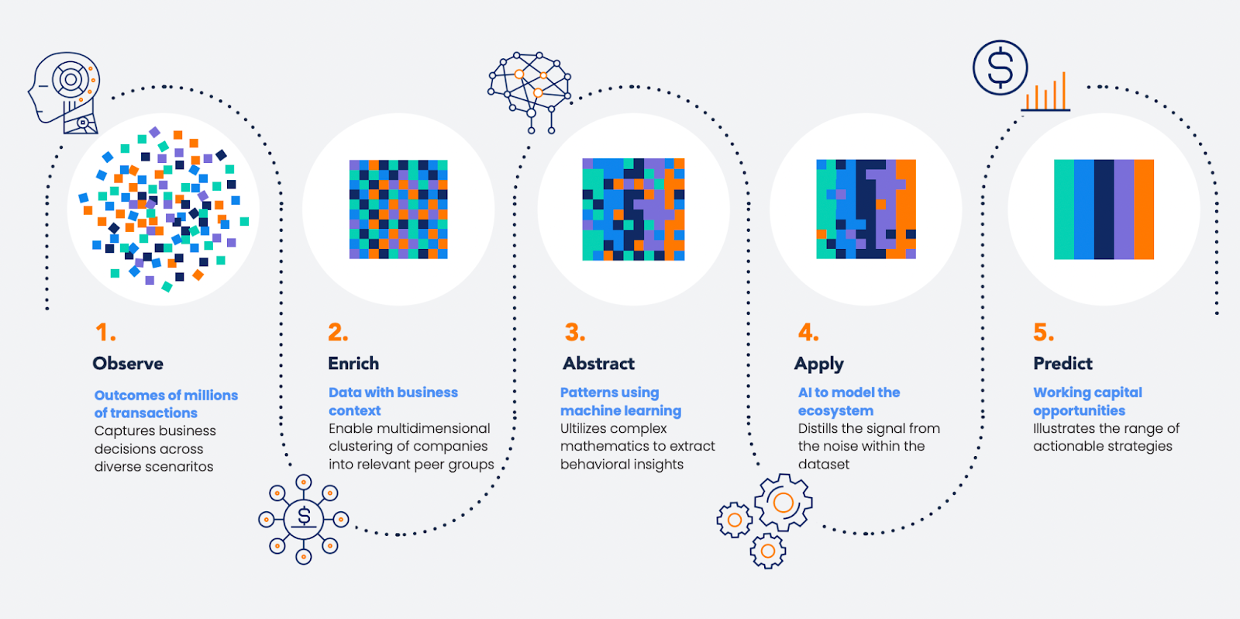

Taulia Analytics dashboards aggregate and analyze millions of supplier transactions, from more than 600,000 suppliers, conducted on the Taulia portal since 2009. The dashboards provide immediately usable data to customers, without going through data mapping and cleansing. Taulia Analytics dashboards leverage buyer-provided network data and combine it with third-party data providing firmographics and other information. The dashboards leverage AI-powered prediction models which can accurately predict supplier behavior.

The analytics dashboards provide customers with business trends while helping companies set goals, compare themselves to industry averages, and streamline their supply chains. The dashboards enable businesses to monitor performance and explore the implications of strategic working capital decisions by leveraging historical, industry, and real-time data. Artificial Intelligence (AI) gives buyers a far more detailed understanding of the potential benefits of working capital strategies, and of how different techniques can be deployed to achieve the company’s goals.

The flexible Taulia Analytics dashboards let customers examine their entire supply chains, groups of suppliers, or a single supplier, and help customers:

-

Make data-driven decisions with predictive insights - Optimize your working capital and play out different scenarios without the risks involved with actually performing the changes. Predict which invoices suppliers will choose to accelerate under a range of different conditions or extend the cash forecasting process all the way down to the purchase order level, providing a clearer view of supplier health and the impact that different actions could have on the company’s supply chain.

-

Evolve your working capital program and meet objectives with clear next steps - Gain a holistic view of your working capital program to be proactive in improvement with actionable insights.

-

Benchmark against peers in order to be a business supplier wants to sell to - Become more profitable by better understanding suppliers and larger industry trends with the most comprehensive look available at payment trends across numerous industries. Make actionable decisions on how to strengthen supply chains and increase efficiency.

-

Meet company cash-related objectives, goals, and targets - Realize cash opportunities to optimize working capital, generate yields, and ensure supply chain strength.

-

Track and monitor program performance - Track statistics on supplier data and transactions and understand dynamics in real time.

-

Filter across business units and drill down to specifics - Monitor payables across business units to optimize cash outflows and discount yield.

Taulia Analytics Process

Contents

Buyer Landing Page: Financial

Payables Measure

Deploy Cash

Financial Supply Chain Analytics

Payables Planner

Payables Benchmark

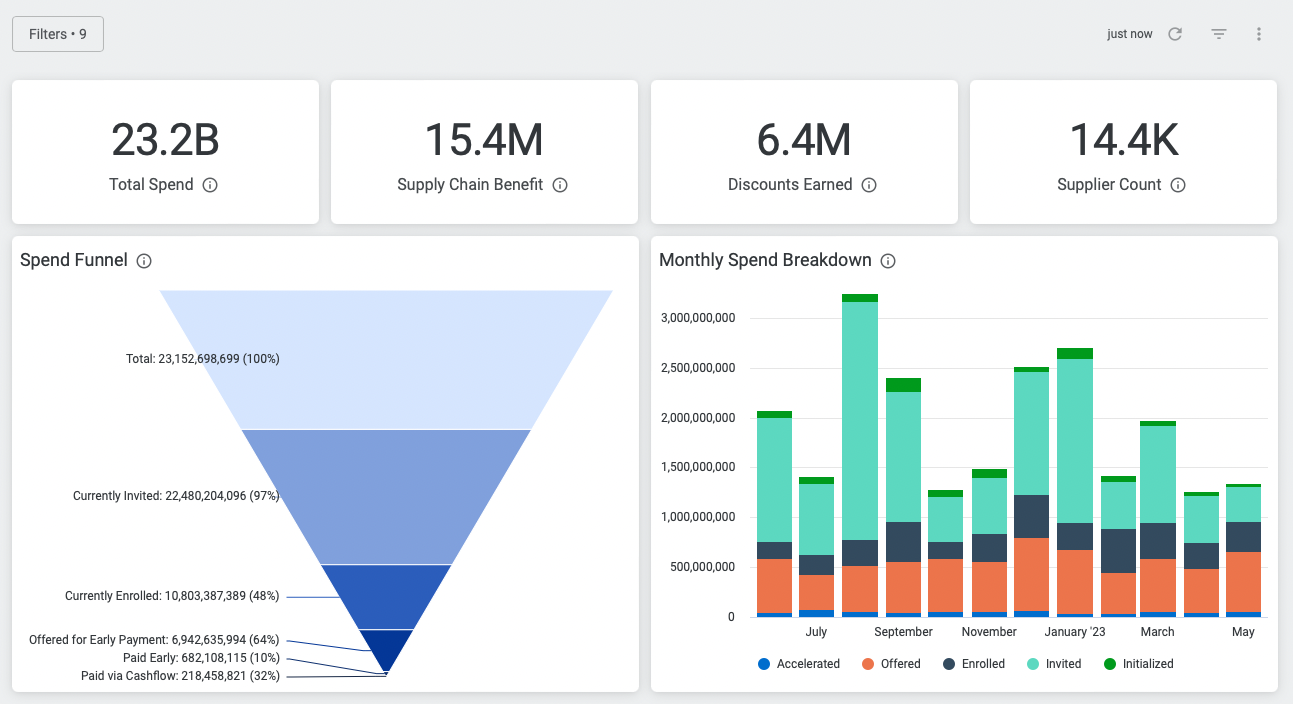

Buyer Landing Page: Financial

High-level program insights for buyers focused on supplier onboarding.

To access the page log into the Taulia Network UI and navigate to Home. On this page, you will find high-level program insights for buyers focused on supplier onboarding.

- Total spend - Display the sum of paid invoices for all suppliers (including suppliers not yet invited) where the invoice was paid for the period selected

- Supply Chain benefit - Collective working capital improvement forecast based on the period selected for suppliers participating in the Early Payment program. Illustrates the benefit realized by suppliers

- Discounts Earned - Sum of discount amounts deducted from paid invoices where the invoice was paid for the period selected. The gross amount does not include discounts on 3rd party funded early payments (SCF)

- Supplier Count - Count of supplier connections

- Spend Funnel - Total spend (sum of paid invoices) for the period selected by the following key stages. Percentages shown in the labels are based on the prior stage.

-

Total: Spend for which supplier master data has been transferred to Taulia

-

Currently Invited: Spend of all invited suppliers (invited as of today)

-

Currently Enrolled: Spend of all enrolled suppliers (enrolled as of today)

-

Offered for Early Payment: Spend offered for early payment (to suppliers who were enrolled before or on the day of payment)

-

Paid Early: Spend accelerated (by suppliers enrolled and offered for early payment)

-

Paid via Cashflow: Spend accelerated automatically via Taulia’s Cashflow functionality

- Monthly Spend Breakdown - Paid invoices for suppliers grouped by the date the invoice was paid. Each group is mutually exclusive

-

Initialized: Monthly spend of suppliers for which supplier master data has been transferred to Taulia, but haven’t been invited as of the payment d

-

Invited: Monthly spend of suppliers who were invited before or on the day of payment, but haven’t been enrolled as of the payment date

-

Enrolled: Monthly spend of suppliers who were enrolled before or on the day of payment, where the invoice was not offered for early payment

-

Offered: Monthly spend of suppliers who were enrolled before or on the day of payment, where the invoice was offered for early payment but was not accelerated

-

Accelerated: Monthly spend of suppliers who were enrolled before or on the day of payment, where the invoice was offered for early payment and accelerated

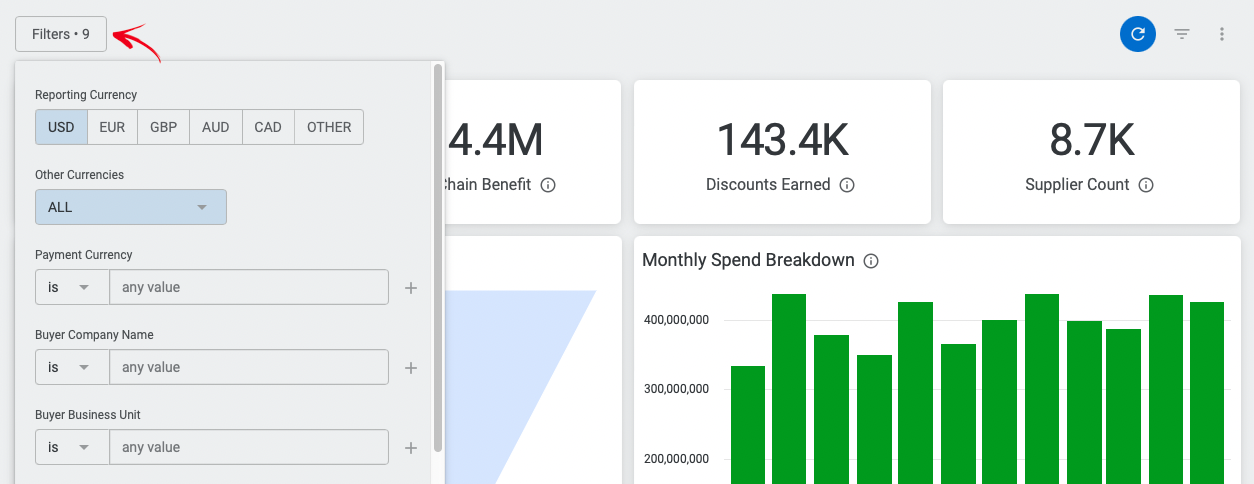

If you click on Filters you will have more options to adjust your report request.

Below you will find a list with a description of all filters:

-

Reporting Currency - Invoice currency Default value: “USD”. Used in adjusting the aggregate and document-level currency reporting amounts (with the exception of columns specifically denoting "local currency amount")

-

Other Currencies - Invoice currency (additional options) Default value: “AED”. Applied if “Other” is selected in Reporting Currency filter

-

Payment Currency - Supplier payment currency

-

Buyer Company Name - Buyer company name

-

Buyer Business Unit - Buyer business unit name (and number)

-

Supplier Segment Name - Supplier segment name

-

Current Supplier Status - Supplier engagement state as of today

-

Supplier Industry - Supplier Industry

-

Supplier Payment Date - Supplier Payment Date Default value: “Is in the last 12 complete months”.

Note: Data includes paid invoices from the last 3 years based on a supplier payment date.

Key Definitions and Calculations

- Total Spend, Total in Spend Funnel, and the sum of all elements in the Monthly Spend Breakdown are all aligned for the same selected period.

- Offered for Early Payment in Spend Funnel and the sum of Offered and Accelerated in Monthly Spend Breakdown are aligned for the same selected period.

- Paid Early in Spend Funnel and the sum of Accelerated in Monthly Spend Breakdown are aligned for the same selected period.

- Supply Chain Benefit: Sum product of invoice amount and Early Payment Tenor divided by selected period length.

Payables Measure

A provocative dashboard that gives users a unique view of payables working capital impacts from changes in payment terms and spending volume.

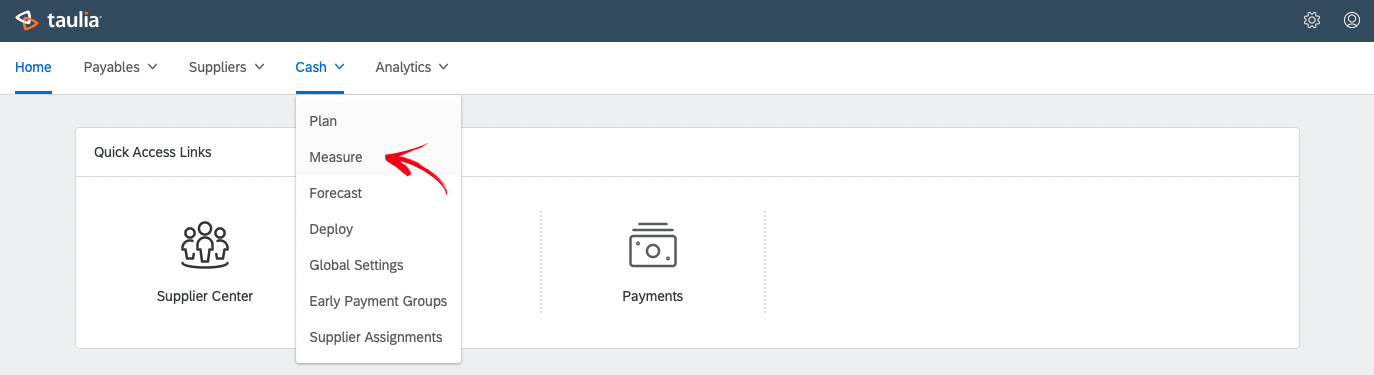

To access the page log into the Taulia Network UI and click on Cash > Measure.

Quantify the impact changes in spend, supplier payment terms, and payment issuance are having on your working capital.

On this page, you will find the below information boxes:

-

Beginning payable - Total Payable on the first day of the filtered range. Includes invoices that were approved before the first day of the filtered range but haven’t yet been paid as of the first day of the filtered range (based on buyer payment date)

-

Invoices Confirmed - Invoice total for all approved invoices (whether open or paid). Includes all invoices that were approved within the filtered range

-

Invoices Paid - Sum of paid invoices where due. Includes invoices that were approved before or on the last day of the filtered range and were paid within the filtered range (based on buyer payment date)

-

Ending Payable - Total Payable on the final day of the filtered range. Includes invoices that were approved before or on the last day of the filtered range but haven’t yet been paid as of the last day of the filtered range (based on buyer payment date)

-

Payables Trend - Accumulative change to working capital in the filtered range. Contributions grouped by changes in invoice terms and spend

-

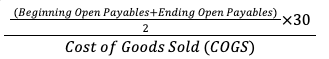

Indicative Monthly DPO - Calculated by averaging the open payables at the beginning of the month and the open payables at the end of the month, multiplied by 30 days, divided by monthly spending. COGS is estimated as the spend invoiced during the period (assuming the beginning and ending inventory remains unchanged).

-

Payables Impact by Supplier - A list of all suppliers with spend within the filtered range. Provides beginning and ending spend, terms, outstanding payables, and the change in payables over the filtered range for each supplier, calculated based on the invoice date and due date. Can be used to understand the suppliers with the largest impact on working capital over a period of time.

-

Payables Impact by Document - List of invoices paid before or after the invoice due date by the buyer. This report can be used to understand the impact on working capital resulting from actual payment behavior. Invoices paid early as a result of traditional discount terms or dynamic discounting are included.

Note: Accelerated SCF invoices are not included because third-party funding has no impact on the buyer’s working capital. Report includes details at the invoice level, for invoices paid (based on buyer payment date) within the filtered range. Excludes documents paid on the due date because they have no impact on the balance sheet.

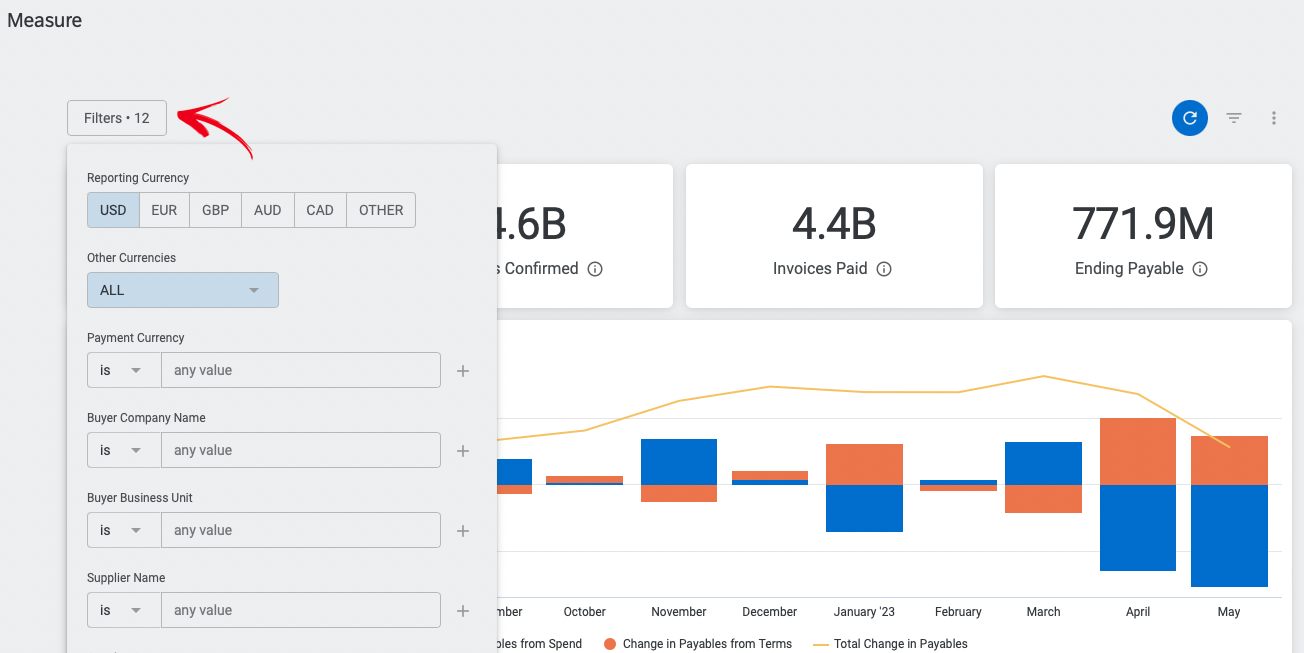

If you click on Filters you will have more options to adjust your report request.

Below you will find a list with a description of all filters:

-

Reporting Currency - Invoice currency Default value: “USD”

-

Other Currencies - Invoice currency (additional options) Default value: “AED”. Applied if “Other” is selected in Reporting Currency filter

-

Payment Currency - Supplier payment currency

-

Buyer Company Name - Buyer company name

-

Buyer Business Unit - Buyer business unit

-

Supplier Name - Supplier name

-

Supplier Segment Name - Supplier segment name

-

Supplier Industry - Supplier Industry

-

Supplier Country - Supplier Country

-

Supplier Vendor Number - Supplier Vendor Number

-

Filter Date - Period selection Default value - “Is in the last 12 complete months”

-

SCF Program Participants - Limits results to invoices for suppliers after they have enrolled and had at least one invoice eligible for SCF. This only applies to the following charts: Beginning Payable, Invoices Confirmed, Invoices Paid, Ending Payable

Note: Data includes approved invoices after the year 2011 (based on invoice date) for which the due date is not missing

Key Definitions and Calculations

- Beginning Open Payables - For a selected period (month), the sum of invoices of which invoice date is before the beginning of the selected period and the due date is on or after the beginning of the selected period

- Ending Open Payables - For a selected period (month), the sum of invoices of which invoice date is on or before the end of the selected period and the due date is after the end of the selected period

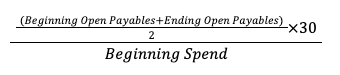

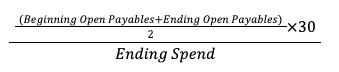

- DPO:

- COGS: Beginning Inventory + Purchases - Ending Inventory (in this analysis, it is assumed that beginning and ending inventory remains unchanged and COGS is estimated as the spend invoiced during the period)

- Change in Payables from Spend

- Change in Payables from Terms

- Beginning Spend - Sum of invoices in the first month of the filtered range (based on invoice date)

- Ending Spend - Sum of invoices in the last month of the filtered range (based on invoice date)

- Beginning Average Term - For the first month of the filtered range

- Ending Average Term - For the last month of the filtered range

- Delta Payable - Difference between the Ending Open Payables of the last month of the filtered range and the Beginning Open Payables of the first month of the filtered range.

- Payables Impact - Equals invoice amount for the “Late Payment” payment category and (-1 Invoice Amount) for all other payment categories.

Deploy Cash

Buyer-funded early payment insights (available for DD customers only)

To access the page log into the Taulia Network UI and click on Cash > Deploy in the Taulia Network UI.

On this page, you will find the below information boxes:

-

Early Payment Avg APR - Weighted Average APR for buyer-funded early payments made during the period.

-

Spend Accelerated - Invoice Gross Amount of buyer-funded (DD) invoices accelerated in the filtered set.

-

Net Impact to Avg Payment Days - Weighted impact of buyer-funded early payments to average payment days during the period.

-

Discounts Earned (DD) - Sum of gross discount amounts deducted from buyer-funded accelerated invoices where the invoice was paid during the period.

-

Discounts Earned by Method - Sum of gross discount amounts deducted from buyer-funded accelerated invoices where the invoice was paid during the period broken out by month and by acceleration type.

-

Supplier List - A comprehensive list of the data from this dashboard aggregated by supplier. Users may download the entire list for additional analysis.

-

Monthly Spend Breakdown - Paid invoices for suppliers grouped by the date the invoice was paid. Each group is mutually exclusive:

- Initialized: Monthly spend of suppliers for which supplier master data has been transferred to Taulia, but haven’t been invited as of the payment date

- Invited: Monthly spend of suppliers who were invited before or on the day of payment, but haven’t been enrolled as of the payment date

- Enrolled: Monthly spend of suppliers who were enrolled before or on the day of payment, where the invoice was not offered for early payment

- Offered: Monthly spend of suppliers who were enrolled before or on the day of payment, where the invoice was offered for early payment but was not accelerated

- Accelerated: Monthly spend of suppliers who were enrolled before or on the day of payment, where the invoice was offered for early payment and accelerated

Below you will find a list with a description of all filters:

-

Reporting Currency - Invoice currency, default value: “USD”

-

Other Currencies - Invoice currency (additional options), default value: “AED”. Applied if “Other” is selected in the Reporting Currency filter

-

Payment Currency - Supplier payment currency

-

Buyer Company Name - Buyer company name

-

Buyer Business Unit - Buyer Business Unit

-

Supplier Country - Supplier Country

-

Supplier Name - Supplier Name

-

Supplier Segment Name - Supplier Segment Name

-

Supplier Industry - Supplier Industry

-

Supplier Vendor Number - Supplier Vendor Number

-

CashFlow - Supplier Cashflow status (Only for Suppliers taking DD early payments using Cashflow)

-

Supplier Status - Supplier engagement state as of today

-

Filter date - Period selection, default value: “Is in the last 12 complete months”

Note: Data includes paid invoices from the last 3 years based on supplier payment date.

Financial Supply Chain Analytics

Payment term-focused payables insight

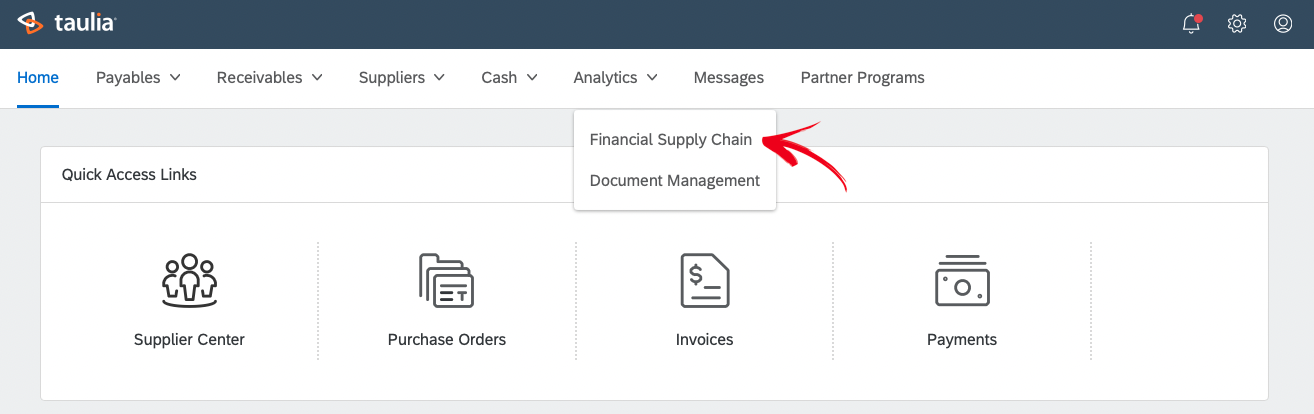

To access the page log into the Taulia Network UI and click on Analytics > Financial Supply Chain.

On this page, you will find the below information boxes:

-

Total Spend - Invoice gross amount for all invoices initialized (visible) to the Taulia Platform

-

Spend Enrolled - Invoice gross amount for all invoices for enrolled suppliers on the Taulia Platform

-

Spend Offered - Invoice gross amount for all invoices offered for early payment on the Taulia Platform where the supplier was enrolled as of the invoice date

-

Supplier Count - Count of supplier relationships out of supplier company and buyer business unit. Only suppliers with paid spend will be counted

-

Payment Term Targets - Targeted payment terms (bucketed for usability) from the current executable plan, as defined by the user

-

Vendor Master Terms - Distribution of spend by Vendor Master Term description or code (where known) aggregated by supplier

-

Effective Days to Pay - Average effective days to pay (Supplier Payment Date - Invoice Date) across all invoices (bucketed for usability)

-

Invoice Terms - Distribution of spend by Invoice term

-

Early Payments Offered by Month - Gross amount of all invoices paid during the month that were offered for acceleration prior to payment. Note: Invoice is aggregated only in the month in which it was paid even if the offer was available across multiple months.

-

Supplier Engagement by Month - Count of suppliers offered at least one early payment in the period

-

Acceleration Window - Average approval time and average payment term based on invoice due dates.

-

Supplier List - A Comprehensive list of the data from this dashboard aggregated by supplier. Users may download the entire list for additional analysis

Below you will find a list with a description of all filters:

-

Reporting Currency - Invoice currency, default value: “USD”

-

Other Currencies - Invoice currency (additional options), default value: “AED”. Applied if “Other” is selected in the Reporting Currency filter

-

Payment Currency - Supplier payment currency

-

Buyer Business Unit Country - Buyer business unit country

-

Buyer Company Name - Buyer company name

-

Buyer Business Unit - Buyer business unit

-

Supplier Status - Supplier engagement state as of today

-

Supplier Industry - Supplier Industry

-

Supplier Segment Name - Supplier segment name

-

Supplier Country - Supplier Country

-

Gap Label - Proprietary program optimization metric (work with your account success team).

-

Filter Date - Period selection, default value: “Is in the last 12 complete months”

Note: Data includes paid invoices from the last 3 years based on supplier payment date.

Payables Planner

Taulia’s Payables Planner is an interactive tool designed to provide Taulia customers with better visibility into supplier payment terms and liquidity demand. Users can easily see how their working capital position could change over time based on predictive scenarios.

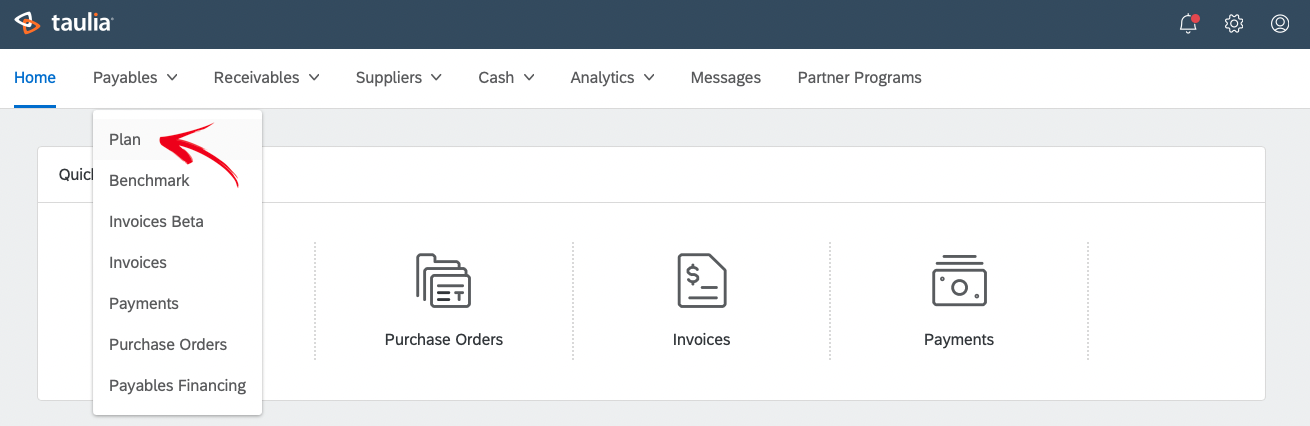

To access the page log into the Taulia Network UI and click on Payables > Plan.

On this page, you will find the below information boxes:

- Baseline Metrics:

-

Supplier Count - Count of distinct supplier names

-

Spend Analyzed - Total annual spend of suppliers analyzed herein

-

Spend in Scope - Spend which is not excluded. Excluded spend consists of buyer exclusions, industry exclusions, and exclusions because of traditional payment terms. See 'Out of Scope Spend' chart below for additional information.

- Current Average Terms - The spend-weighted average effective payment term for all suppliers.

- Target Average Terms - The resultant average term (‘DPO’) for the entirety of the Spend File (in scope and excluded suppliers) based on improvements from Target Payment Terms x Target Term Adoption.

- Estimated Payables - based on the current spend and terms

- Target Payables - based on the current spend and target terms

- Strategic Scenarios - Working Capital released to or required from Treasury and supplier liquidity demand for each Payables Strategy

- Term Target Defensibility - Modeled defensibility of term target based on current terms, peer observations, and observations across the Taulia network. Scores of “0” indicate target supplier terms exceed a national late payment directive

- Out of Scope Spend - Excluded spend consists of Buyer Exclusions, Intercompany, Government, Utilities / Financials, and terms less than the average approval time.

- Payment Term Distribution - Current and target payment terms distribution

- AP Balance Impact - Expected funding requirement (Working Capital required) for Dynamic Discount Program based on predicted early payment adoption above buyer floor and within buyer funding budget (see Buyer Funding in Filters).

- DPO Impact - Average terms reduction resulting from the funding of the DD program

- Average Return on Capital - Expected blended program APR for Dynamic Discounting early payments

- Discount Capture - Projected gross discounts from buyer-funded early payments powered by Taulia (excludes Traditional and DPT discounts)

- Liquidity Demand by APR - Predicted liquidity demand (in terms of Working Capital impact to Supplier) at each APR

- DD Adoption - Expected acceleration of offered early payments within DD scope.

- SCF ADoption - Expected acceleration of offered early payments within SCF scope

- Self-Funded Early Payments - Percentage of overall early payment program expected to be funded by buyer.

- WC benefit to Suppliers - Net working capital impact to the supply chain from the movement of supplier terms and predicted adoption of early payment offers

- Early Payment Adoption - 'SMB' = suppliers with less than 50M USD estimated annual revenue. 'Midsize' = suppliers with between 50M and 1B USD estimated annual revenue. 'Large Enterprise' = suppliers with more than 1B USD estimated annual revenue

Below you will find a list with a description of all filters:

-

Reporting Currency - Invoice currency, default value: "USD"

-

Other Currencies - Invoice currency (additional options), default value: “AED”. Applied if “Other” is selected in the Reporting Currency filter

-

Buyer Company Name - Buyer company name

-

Spend File - Supplier spend file (provided by the buyer) or “LIVE Data” for a snapshot of a live program

-

Term Extension Adoption - Used in calculating the marginal difference between the baseline case (No Term Extension if the filter is set to 0) and target case (With Term Extension if the filter is set to 100). Impacted fields include funding assets required, spending accelerated, gross outreach yield, working capital released, and liquidity demand. The default value is 100%

-

Buyer Funding Percent - Percentage of the maximum allowed funding budget (provided by the buyer) the buyer is willing to use. The default value is 100%

-

Buyer APR Floor - The minimum APR percentage the buyer is willing to fund. The default value is 6%

-

Buyer Business Unit - Buyer business unit

-

Buyer Business Unit Country - Buyer business unit country

-

Payment Currency - Supplier payment currency

-

Supplier Country - Supplier Country

-

Supplier Industry - Supplier Industry

-

Supplier Spend - Annual Spend

-

Supplier Terms - Current Terms

-

Supplier Addressable - In Scope. Excluded spend consists of Buyer Exclusions, Intercompany, Government, Utilities / Financials

-

Scenario Description - Strategic scenario name

-

Supplier Segment Name - Supplier segment name

-

Visualize Unknown Industry Sector - Display the “Unknown” sector in the “Early Payment Adoption by Sector” chart

-

Business Case Class - Business case spend files are archived after 6 months

Buyer provides their suppliers’ spend file, maximum allowed funding budget, and optionally maximum APR percentage for funding early payments (24% by default). Data includes business cases from the last 1 year.

After selecting the Buyer Name and corresponding Spend File from the filters, the user can interactively configure the following filters:

-

Buyer APR Floor - The minimum APR percentage the buyer is willing to fund. The default value is 6%.

-

Buyer Funding Percent - Percentage of the maximum allowed funding budget (provided by the buyer) the buyer is willing to use. The default value is 100%.

-

Term Extension Adoption - Used in calculating the marginal difference between the baseline case (No Term Extension if the filter is set to 0) and target case (With Term Extension if the filter is set to 100). Impacted fields include funding assets required, spending accelerated, gross outreach yield, working capital released, and liquidity demand. The default value is 100%.

Key Definitions

Using suppliers’ spend file, Tualia runs predictive scenarios to assess whether suppliers will choose to accelerate payments under different conditions. The machine learning models take into account dozens of attributes to determine the likelihood of supplier acceptance of early payments at each APR level. The predictive models can provide insight into the yield from early payments with varying rates and tenors and help find the APR that best balances supplier adoption levels against the rate of return.

To determine the most appropriate APR to offer suppliers, the target APR is selected based on the optimum net yield (calculated as the maximum product of APR and early payment adoption probability) for each supplier. The APR percentage and the probability of acceptance that correspond to the maximum net yield are selected as the target APR for each supplier. In the case that the target APR is lower than the Buyer APR Floor value (selected by the user from the dashboard filter), the APR percentage and the probability of acceptance that corresponds to the Buyer APR Floor or (SCF Floor if it is lower than the Buyer APR Floor value) is selected as the target APR instead. SCF Floor is calculated as LIBOR + margin.

All early payments with a target APR at or above the buyer APR floor (up to the maximum funding APR limit) will be paid by Treasury leveraging Dynamic Discounting (if maximum buyer funding limit is reached, the remaining early payments with a target APR at or above SCF floor will be funded by a third party). Any early payments with a target APR below the Buyer APR Floor and at or above the SCF floor will be funded by a third party.

Scenario Description

-

No Terms Extensions - This scenario assumes no adjustment to current payment terms.

-

Supplier Top Quartile DSO respecting Late Payment Directives - This scenario details the Working Capital impact and supplier adoption metrics if payment terms for each supplier are set at the 75th percentile of DSO for each supplier's industry. If the resulting payment term exceeds a national late payment directive for the supplier's country, the payment term will be adjusted to the maximum allowable term for that jurisdiction.

-

Harmonized Terms - This scenario details the Working Capital impact and supplier adoption metrics if suppliers are put into the harmonized buckets (45, 60, 90 days) above their median DSO. If the resulting payment term exceeds a national late payment Directive for the supplier's country, the payment term will be adjusted to the maximum allowable term for that jurisdiction.

-

Custom - This scenario details the Working Capital impact and supplier adoption metrics if payment terms for each supplier are set according to a custom plan.

Calculations

-

Funding Asset Required - Annual Spend x Target Acceleration Window x Likelihood to Accept the Target APR / 360

-

Target Acceleration Window - Target Supplier Term - Days to Approve Invoice

-

Current Average Terms - Weighted Average of Current Terms and Annual Spend

-

Target Average Terms - Current Average DPO + Term Extension DPO Impact

-

Current Average DPO - Weighted average of Current Terms and Annual Spend

-

Term Extension DPO Impact - Working Capital Released / Total Annual Spend

-

Estimated Payables - Current Average Terms x Total Annual Spend / 360

-

Target Payables - Target Average Terms x Total Annual Spend / 360

-

Working Capital Impact - Working Capital Released - Funding Asset Required (DD only)

-

Supplier Liquidity Demand - Target Acceleration Window x Likelihood to Accept the Target APR x Annual Spend / 360

-

Term Target Defensibility Score - A proprietary metric to measure how reasonable the term target is

-

Average Return on Capital - Gross Outreach Yield (DD only) / Funding Asset Required (DD only)

-

Gross Outreach Yield - Annual Spend x Target Acceleration Window x Likelihood to Accept the Target APR x Target APR / 360

-

Discount Capture - Gross Outreach Yield (DD only)

-

DPO Impact - Funding Asset Required (DD only) / Total Annual Spend

-

AP Balance Impact - Funding Asset Required (DD only)

-

DD Adoption - Weighted Average of Likelihood to Accept the Target APR and Annual Spend for DD-funded suppliers

-

SCF Adoption - Weighted Average of Likelihood to Accept the Target APR and Annual Spend for SCF-funded suppliers

-

Self-Funded Early Payment - Funding Asset Required (DD only) / Total Funding Asset Required

-

WC benefit to Suppliers - Total Funding Asset Required

-

Early Payment Adoption Rate - Weighted Average of Likelihood to Accept the Target APR and Annual Spend

Payables Benchmark

Taulia’s Payables Benchmark dashboard allows users to measure their company’s performance against their peers, identify opportunities for working capital improvement, and obtain Network insights such as supplier match and propensity to adopt cards.

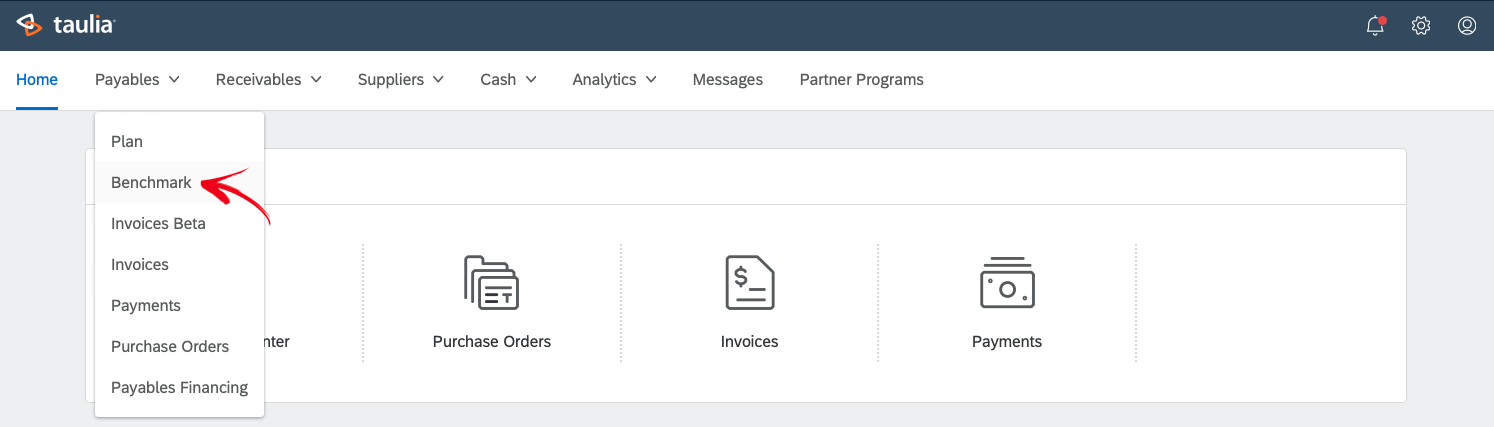

To access the page log into the Taulia Network UI and click on Payables > Benchmark.

On this page, you will find the below information boxes:

-

Publicly Reported DRO Trend - Days Payable Outstanding and peer competitors as defined by CapIQ

-

Peer DPO - Days Payable Outstanding for peer competitors as defined by CapIQ

-

Supplier Payment Terms Comparison - Bars show the average days to pay suppliers in the filtered cohort compared to the average DSO of the supplier's industry sector as defined by CapIQ

-

Network Spend - Percentage of your supply chain already interacting on the Taulia Network

-

Card Adoption - Propensity to adopt cards is a modeled score that considers factors including the supplier's spending levels, average ticket size, and price sensitivity to predict the likelihood of the supplier accepting cards

Below you will find a list with a description of all filters:

-

Reporting Currency - Invoice currency, default value: “USD”

-

Other Currencies - Invoice currency (additional options), default value: “AED”. Applied if “Other” is selected in the Reporting Currency filter

-

Buyer Company Name - Buyer company name

-

Spend File - Supplier spend file (provided by the buyer) OR “LIVE Data” for a snapshot of a live program

-

Term Extension Adoption - Used in calculating the marginal difference between the baseline case (No Term Extension if the filter is set to 0) and target case (With Term Extension if the filter is set to 100). Impacted fields include funding assets required, spending accelerated, gross outreach yield, working capital released, and liquidity demand. The default value is 100%

-

Buyer Funding Percent - Percentage of the maximum allowed funding budget (provided by the buyer) the buyer is willing to use. The default value is 100%

-

Buyer APR Floow - The minimum APR percentage the buyer is willing to fund. The default value is 6%

-

Buyer Business Unit - Buyer business unit

-

Buyer Business Unit Country - Buyer business unit country

-

Payment Currency - Supplier payment currency

-

Supplier Country - Supplier Country

-

Supplier Industry - Supplier Industry

-

Supplier Spend - Annual Spend

-

Supplier Terms - Current Terms

-

Supplier Addressable - In Scope. Excluded spend consists of Buyer Exclusions, Intercompany, Government, Utilities / Financials

-

Scenario Description - Strategic scenario name

-

Supplier Segment Name - Supplier segment name

-

Visualize Unknown Industry Sector - Display the “Unknown” sector in the “Early Payment Adoption by Sector” chart

-

Business Case Class - Business case spend files are archived after 6 months

Key Definitions and Calculations

Supplier Liqyudity Demand - ((Current Supplier Term - Days to Approve Invoice)*(Predicted Adoption * Annual Spend))/365.

Related Articles:

The Accounts Payables Turnover Ratio

Accounts Payable Metrics and KPIs Worth Tracking

Guide to Accounts Payable Outstanding

Harnessing the Power of AI